While all methods of payment have some environmental cost associated with them, payment cards are made from synthetic plastic PVC, which doesn’t biodegrade and produces a lot of greenhouse gas. With fewer data stops, middlemen and the speed of digital payments, it’s estimated that an instant payment can produce up to 80% less CO2.

Take cash for example. Manufacturing bank notes or minting new coins requires an abundance of natural resources, as well as electricity and fuel. Moreover, transporting physical cash between towns and cities requires vehicles on the roads, many of which may be running on diesel. Both manufacturing and distribution will result in the emission of thousands of tonnes of CO2 each year, with a 2021 study suggesting that, based on resources used and CO2 released, for every $1USD produced, the cost to the environment is $0.26 annually per note.

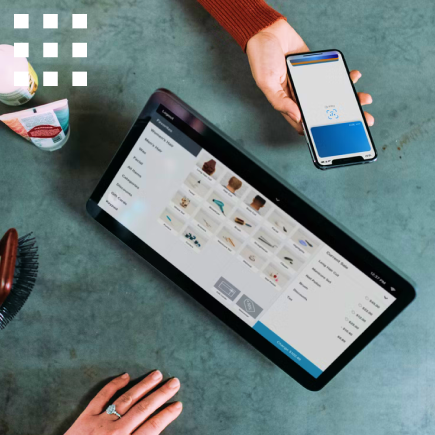

Paying with a virtual card or mobile wallet largely sidesteps these environmental costs. Virtual cards, for instance, avoid producing new plastic cards, as well as couriering them through the mail to customers. Mobile wallets, on the other hand, use pre-existing and ubiquitous infrastructure such as smartphones and mobile networks, reducing the footprint of payments even further.

Both virtual cards and mobile wallets have the added benefits of eliminating paper receipts. According to Climate Action in 2019, every year in the US, paper receipts consume more than 3 million trees, 9 billion gallons of water, and generate the equivalent CO2 emissions of 450,000 cars on the road.

There are a myriad of new, eco-friendly initiatives and plug-ins further driving increased sustainability across eCommerce, too. For instance, there are companies which help customers to mitigate the greenhouse gas emissions associated with the products and services they’ve purchased. Meanwhile, digital POS terminals can enable merchants to support charitable causes they’re passionate about by allowing customers to round up their purchases with donations